Feb 4, 2025

Quantifying the financial benefits of zero trust network architecture for M&A IT integration

Editor's Note: This guest contribution is by Sami Ramachandran, Managing Director, Zscaler

For mergers and acquisitions that initially go well, they’re still judged by demonstrated value on a reasonable timeline. Many times, technology integration becomes the leading cause for those timelines and budgets getting drawn out. In the worst cases, deals are jeopardized.

It doesn’t have to be that way. In this article, you will learn how to calculate the potential hard dollar savings achievable when zero trust network access (ZTNA) is shared between a Buyer and Target company rather than merging legacy perimeter security-based architecture.

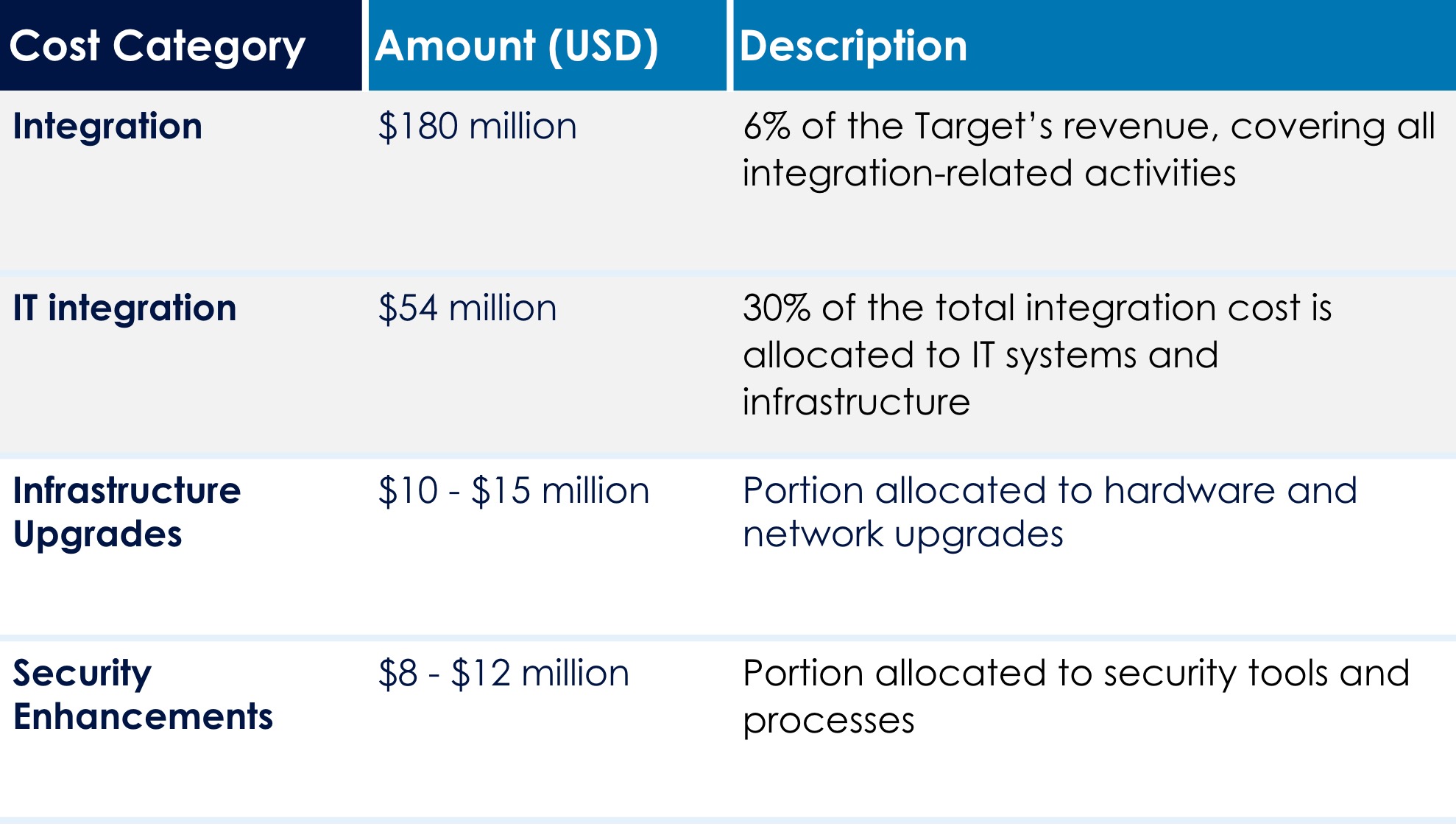

Consider a Buyer partnering with Zscaler to integrate a Target company with 10,000 employees with $3 billion in revenue. Below is the estimated cost breakdown based on an EY study and industry benchmarks.

One-Time Integration Costs Assumptions

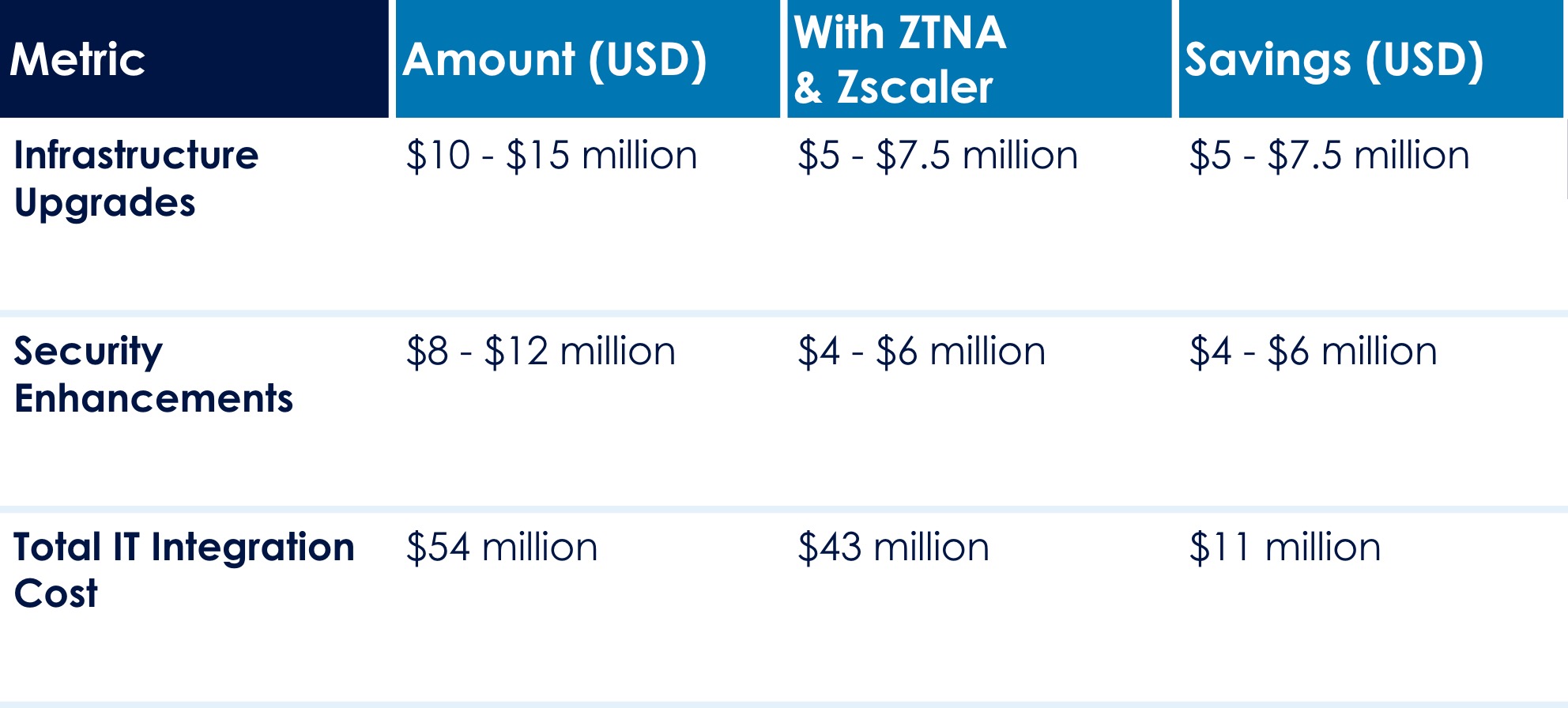

Zscaler ZTNA simplifies integration processes by reducing reliance on physical infrastructure and legacy systems. That means the integration will not require additional VPN concentrators and firewalls. This alone can account for over 50% of infrastructure and security upgrade costs.

Estimated Savings in One-Time Integration Costs with ZTNA and Zscaler

Additional Financial and Operational Benefits

In addition to the estimated savings above, there are other financial and operational benefits:

- Optimizing personnel hours: Reducing the time employees spend on integration efforts allows them to focus on other transformation initiatives, improving productivity and accelerating overall business goals. Typically, the personnel hours required for the technology workstream could be reduced by 30% to 50% with the Zscaler solution.

- Expedited cross-company access: Faster app consolidation and data migration lead to reduced transition timelines and cost efficiencies. Cross-company access can be established in less than a week (for existing Zscaler clients), and in about three to six months for new clients. This is an over 50% reduction in transaction timelines compared to the traditional perimeter security-based approach.

- Faster revenue synergies: Improved integration speed enables companies to realize revenue synergies sooner, unlocking value from the transaction more quickly.

Risk Mitigation During Transactions - Cost Avoidance

The integration phase of M&A is highly vulnerable to cybersecurity risks. Historical data shows breaches during this period can result in significant costs and reputational damage. For example, during the Yahoo-Verizon merger, a previous data breach at Yahoo became public, exposing three billion user accounts. This led to significant reputational damage and reduced the acquisition price by $350 million. By enforcing strict access controls and reducing the attack surface, Zscaler minimizes vulnerabilities, ensuring secure transitions. The benefits include:

- Real-time monitoring: Detects and neutralizes anomalies before they escalate.

- Secure remote access: Enables secure connectivity for all employees, including remote users.

- Regulatory compliance: Ensures adherence to data protection standards, reducing penalties

The bottom line

Technology integration starts with the ability to securely provide cross-company access to employees and third parties. Companies operating on the legacy perimeter security-based architecture are at a huge disadvantage, more so when it comes to integrating a global company with several locations (e.g., office, manufacturing, and warehouse).

By adopting Zscaler ZTNA, organizations get two benefits that pay dividends over the long run: (1) Save approximately 50% in one-time integration costs (up to $24.5 million in the example above); and, (2) They can improve their security posture during critical integration phases.

To learn more about how Zscaler can benefit your organization, please reach out to Sami Ramachandran, Managing Director at Zscaler (sami.ramachandran [@] zscaler.com)

Recommended